Managing money effectively is one of the most important life skills, yet most people struggle with budgeting. Between rising expenses, lifestyle upgrades, and unexpected financial shocks, it’s easy to lose control of where your money goes. One timeless method that simplifies personal finance while keeping you on track toward your goals is the 50-30-20 budget rule.

In this guide, we’ll break down exactly what the 50-30-20 rule is, why it works, how to apply it to your income, and how you can tweak it to fit your lifestyle in India. We’ll also explore tools, tips, and mistakes to avoid so you can make the most of every rupee you earn.

What is the 50-30-20 Budget Rule?

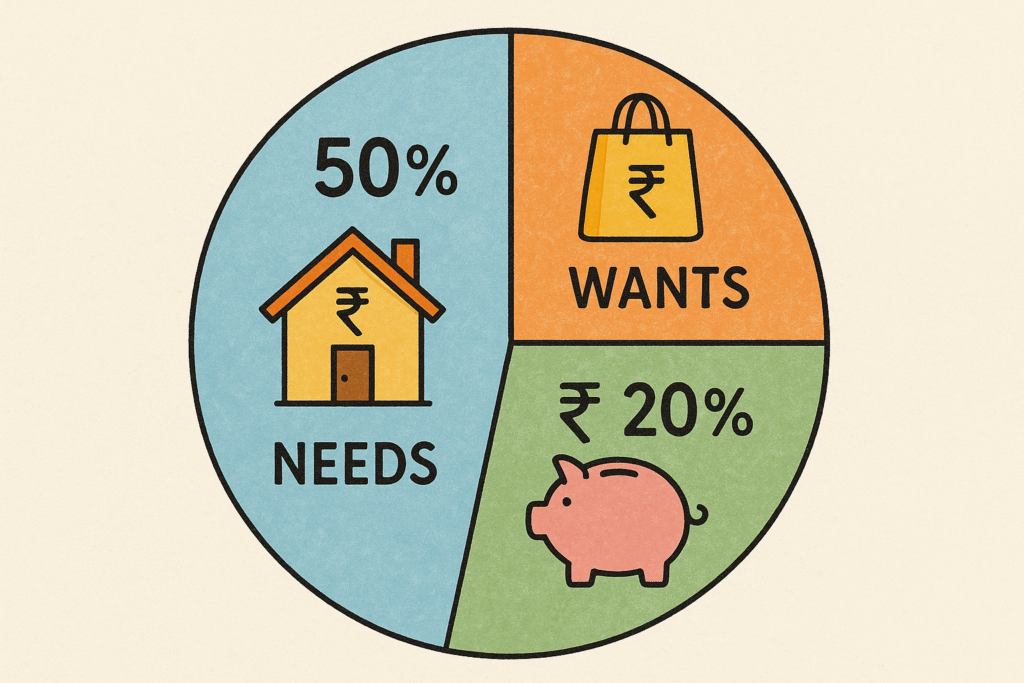

The 50-30-20 budget rule is a simple percentage-based budgeting method that divides your after-tax income into three main categories:

- 50% Needs: Essential living expenses like rent, groceries, utilities, and EMIs

- 30% Wants: Lifestyle choices such as dining out, travel, entertainment, and shopping

- 20% Savings & Debt Repayment: Investments, emergency funds, and paying down loans

This budgeting approach was popularised by Elizabeth Warren, a US Senator and bankruptcy expert, in her book All Your Worth: The Ultimate Lifetime Money Plan. While the concept originated in the West, it works well for Indian households too, with some cultural and financial adjustments.

Why the 50-30-20 Rule Works

The strength of the 50-30-20 rule lies in its simplicity. You don’t need to track every single purchase in detail — you only need to ensure your spending fits into the three categories within the defined percentages.

1. Encourages Balanced Spending

It prevents overspending on lifestyle luxuries while still allowing room for enjoyment.

2. Ensures Consistent Savings

It allocates a fixed proportion to savings before lifestyle spending, making wealth building a habit.

3. Adaptable for All Income Levels

Whether you earn ₹30,000 a month or ₹3 lakh, the percentages remain the same — making it universally applicable.

4. Reduces Decision Fatigue

By limiting categories to three, you spend less mental energy tracking money and more on making better financial choices.

Breaking Down the Categories in Detail

50% – Needs (Essentials)

These are expenses you must pay to maintain a basic standard of living.

Typical examples include:

- Housing costs: Rent or home loan EMI

- Utilities: Electricity, water, gas, and internet

- Groceries & food essentials

- Transportation: Petrol, bus passes, car loan EMI

- Insurance premiums: Health, term life, or vehicle insurance

- Minimum debt repayments

If your needs exceed 50% of your income, it’s a red flag. This could mean you’re living beyond your means in housing or transportation, or you’re carrying too much debt.

Example: If you earn ₹1,00,000 after tax, your needs should not exceed ₹50,000 per month.

30% – Wants (Lifestyle Choices)

These are things that improve your quality of life but aren’t strictly necessary.

Examples include:

- Eating out at restaurants

- Travel and vacations

- Shopping for clothes or gadgets

- Subscriptions (Netflix, Spotify, Amazon Prime)

- Hobbies and leisure activities

Important: Many people confuse wants with needs. For example, your internet bill for work is a need, but a premium OTT subscription is a want.

20% – Savings & Debt Repayment

This category builds your financial security.

It includes:

- Emergency fund contributions

- Investments: Mutual funds, PPF, NPS, stocks, or fixed deposits

- Loan prepayments: Beyond the minimum repayment, to save on interest

- Retirement savings

Financial planners recommend building an emergency fund worth 6 months of expenses before aggressively investing.

How to Apply the 50-30-20 Rule in India

Applying the rule is straightforward:

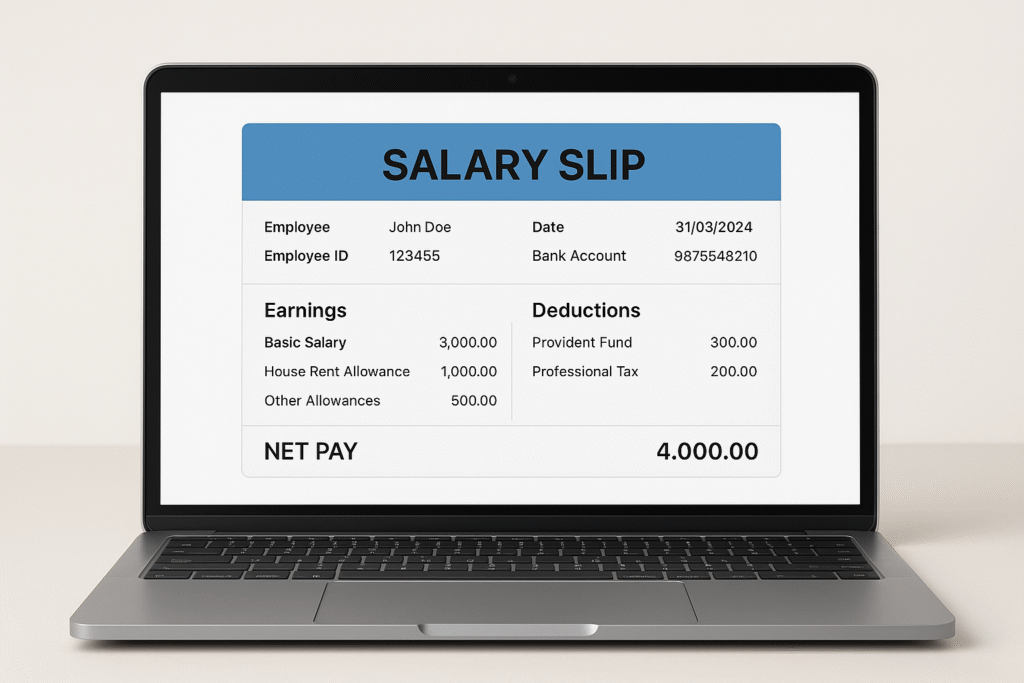

Step 1 – Calculate Your After-Tax Income

Include your net salary, business profits, rental income, and any side hustle earnings.

Step 2 – Categorise Your Expenses

Use your last 2–3 months’ bank and UPI transaction history to classify spending into needs, wants, and savings.

Step 3 – Adjust to Fit the Rule

If your needs take up 70% of your income, you’ll need to cut housing costs or transportation expenses.

Step 4 – Automate Savings

Set up auto-debits for SIPs, PPF, or recurring deposits right after payday.

Real-Life Example for an Indian Professional

Income: ₹80,000 after tax

- Needs (50%): ₹40,000

- Rent: ₹20,000

- Groceries: ₹8,000

- Utilities: ₹5,000

- Transportation: ₹7,000

- Wants (30%): ₹24,000

- Dining out: ₹8,000

- Travel savings: ₹10,000

- Shopping: ₹6,000

- Savings (20%): ₹16,000

- SIP in equity mutual fund: ₹10,000

- PPF contribution: ₹4,000

- Emergency fund: ₹2,000

Adjustments for Indian Cost of Living

While the 50-30-20 rule is a great starting point, in India’s major cities like Mumbai, Bengaluru, and Delhi, housing can easily consume over 40% of your income. In such cases:

- Consider 40-30-30 (reduce needs to 40% and increase savings to 30%) if you have low housing costs in smaller towns.

- For high housing costs, you might temporarily follow 60-20-20, but aim to return to the standard rule.

Tools to Help You Follow the Rule

- Walnut / Money Manager Apps – Track spending automatically via SMS and UPI messages

- Google Sheets Budget Template – Customise for 50-30-20 tracking

- Mutual Fund SIP Platforms – Zerodha Coin, Groww, Paytm Money

For a detailed review of budgeting apps, you can check our upcoming guide on Best Personal Finance Apps in India.

Common Mistakes to Avoid

- Misclassifying wants as needs – This can derail your budget.

- Not adjusting after income changes – If you get a raise, update your allocations.

- Ignoring irregular expenses – Annual insurance premiums or festival spending need to be planned.

- Failing to track small expenses – Frequent ₹200–₹500 spends can add up quickly.

Benefits of Following the 50-30-20 Rule

- Builds financial discipline without overcomplication

- Ensures steady savings growth over time

- Reduces financial stress as you always have a plan

- Encourages mindful spending rather than impulsive purchases

How This Fits Into Your Bigger Financial Plan

The 50-30-20 rule is a foundational budgeting method. Once you master it, you can combine it with:

- The 80/20 Investing Approach – 80% in stable investments, 20% in high-growth assets

- Sinking Funds – For planned big expenses like weddings or buying a car

- Zero-Based Budgeting – For more detailed control over every rupee

If you’re new to investing, you can read our detailed guide on How to Start Investing in India for step-by-step strategies.

Final Thoughts

The 50-30-20 budget rule is not a rigid restriction, but a flexible guideline that helps you maintain balance between living in the present and preparing for the future. In India, where expenses and income patterns can vary widely, you may need to tweak the percentages — but the core principle remains the same: spend less than you earn, save consistently, and invest wisely.

Whether you’re a young professional just starting out, a family managing household expenses, or someone recovering from debt, the 50-30-20 framework can serve as a reliable compass for financial stability and growth.

Internal Linking Suggestions:

- Link to How to Read Your Indian Salary Slip in 2025 (Finance category) when explaining after-tax income.

- Link to How to Start Investing in India when discussing the savings component.

- Link to Best Personal Finance Apps in India when recommending tools.

External Linking Suggestions:

- RBI – Basic Financial Planning Guide for trustworthy budgeting principles

- Investopedia – 50/30/20 Rule for global perspective