💼 Introduction: Why Managing Your Salary Matters More Than How Much You Earn

Whether you take home ₹25,000 or ₹2.5 lakh per month, your long-term financial success isn’t just about the size of your paycheck — it’s about how wisely you manage that paycheck.

Many professionals, from fresh graduates to experienced engineers and managers, fall into the same monthly loop:

Earn → Spend → Repeat.

They work hard all month, clear bills, swipe their cards, enjoy small indulgences — only to ask by month-end:

“Where did all my money go?”

If this feels familiar, you’re not alone.

But managing your salary doesn’t mean living like a monk. It’s not about cutting your favorite coffee or cancelling all leisure plans. It’s about giving every rupee a job — whether it’s spending, saving, investing, or achieving a goal like owning a home, building an emergency fund, or planning early retirement.

With even a simple system in place, you can:

- Spend more mindfully

- Save automatically

- Invest with purpose

- Reduce money-related stress

In this guide, you’ll discover step-by-step strategies that are practical, beginner-friendly, and built specifically for Indian salaried professionals. Learn how to:

✅ Break your income into clear categories (needs, wants, savings, goals)

✅ Automate your finances so they work silently in the background

✅ Track expenses without feeling overwhelmed

✅ Build wealth with simple, time-tested tools

This isn’t a boring finance lecture. It’s a real-world roadmap to help you take control of your salary — and use it as a tool to live better, now and in the future.

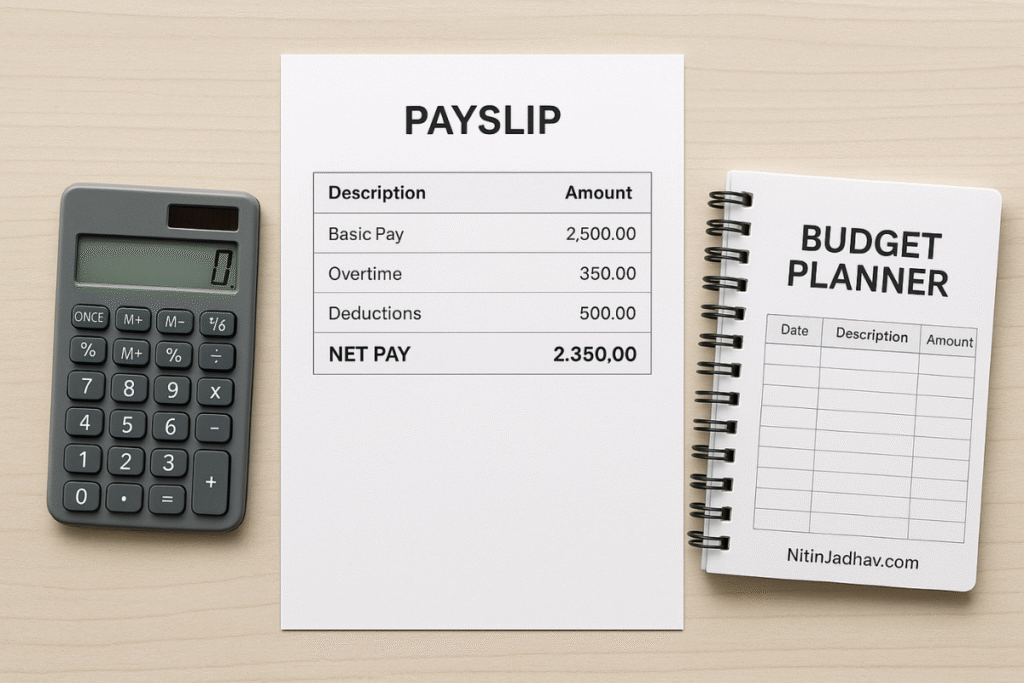

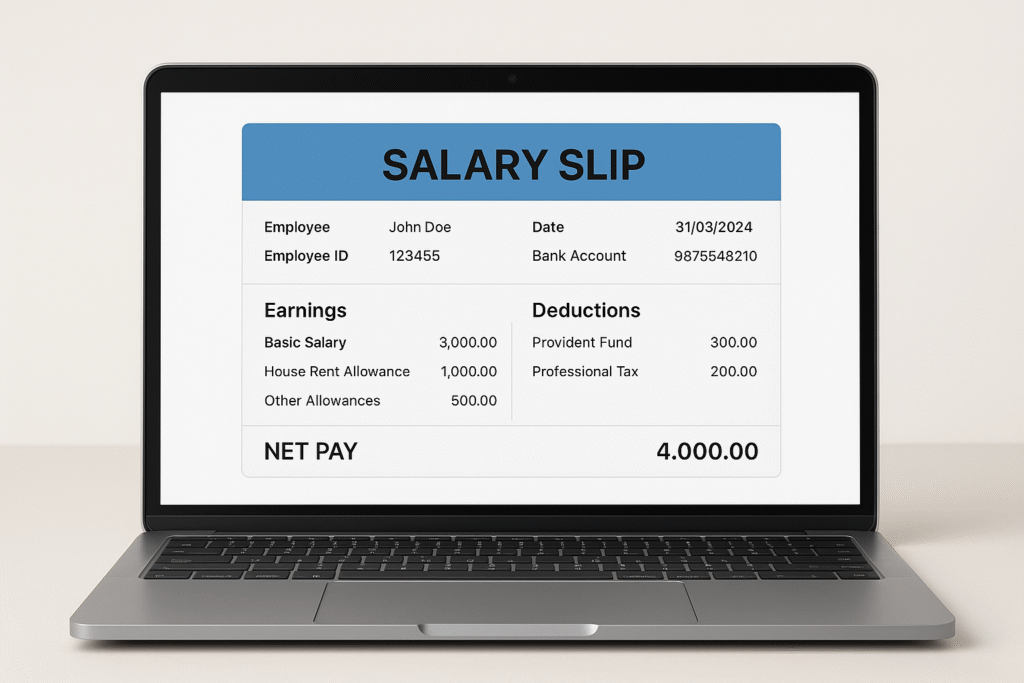

⚙️ Step 1: Know What You Really Earn — Because CTC ≠ In-Hand Salary

Most professionals — especially early in their careers — make the mistake of planning their lifestyle based on their CTC (Cost to Company).

But your actual spending power is determined by your in-hand salary — the amount that gets credited after deductions like PF, tax, and other benefits.

Let’s decode your salary structure:

💼 Key Components of Your Salary Slip

| Component | What It Means | Taxability |

|---|---|---|

| Basic Salary | The core of your salary, affects PF, gratuity, bonuses | Fully taxable |

| HRA (House Rent Allowance) | Helps with rent if you live in rented accommodation | Partially tax-free |

| LTA (Leave Travel Allowance) | For travel within India; can be claimed for tax benefit | Conditions apply |

| Special Allowance | Balancing figure, often the largest chunk | Fully taxable |

| Provident Fund (PF) | 12% deducted from your Basic + 12% from employer | Helps in retirement, reduces taxable income |

| Professional Tax & TDS | State-specific tax and income tax deducted at source | Mandatory |

✅ Action Tip: Create a Personal Salary Breakdown

- Open a spreadsheet

- Break down your CTC into all components

- Subtract PF, TDS, Professional Tax, and any EMIs

- This is your actual take-home salary

💡 Knowing your exact take-home helps you budget better, avoid lifestyle inflation, and invest wisely.

📎 Related: How to Read Your Indian Salary Slip in 2025

📊 Step 2: Use the 50-30-20 Rule — A Simple Budget That Actually Works

Once you know your take-home pay, the next step is to allocate it intentionally.

🔢 50-30-20 Breakdown

| Category | % of Income | Purpose |

|---|---|---|

| Needs | 50% | Essentials — rent, groceries, EMIs, bills |

| Investments / Goals | 30% | Mutual funds, PPF, child’s education |

| Lifestyle / Wants | 20% | Travel, eating out, shopping, subscriptions |

💡 Use tools like Google Sheets, Jupiter App, or ET Money to track where your money is going every month.

🆕 Optional Upgrade for Higher Incomes: 30-40-20-10 Rule

| Category | % Allocation |

|---|---|

| Needs | 30% |

| Investments/Goals | 40% |

| Lifestyle | 20% |

| Emergency Fund | 10% |

📎 Related Read: 50-30-20 Budget Rule Explained

🛟 Step 3: Build Saving Buckets — Save With Purpose, Not Leftovers

Don’t save what’s left after spending. Spend what’s left after saving.

Use the Saving Buckets strategy:

| Bucket | Time Frame | Examples | Tools |

|---|---|---|---|

| Emergency Fund | 0–6 months | Job loss, medical bills | Liquid Funds, Sweep FD |

| Short-Term | 1–3 years | Gadgets, travel, premiums | RD, Ultra Short-Term Debt |

| Medium-Term | 3–7 years | Car, home down payment | Hybrid Mutual Funds |

| Long-Term | 10+ years | Child education, retirement | PPF, NPS, ELSS, SIPs |

💡 Start with an Emergency Fund and work your way through short, medium, and long-term goals.

📎 Related: Saving Buckets Explained

🤖 Step 4: Automate Your Investments — Let Money Work Silently

The wealthiest people don’t rely on discipline. They rely on systems.

Set up auto-debit SIPs and monthly transfers to PPF/NPS.

| Tool | Purpose | Ideal For |

|---|---|---|

| SIPs | Mutual Fund investing | Long-term wealth |

| PPF | Tax-free, safe savings | Retirement corpus |

| NPS | Low-cost pension | Retirement + tax savings |

| SSY | Girl child savings | Long-term education/marriage |

| RD/FD | Short-term saving | Stability seekers |

💡 Set SIPs to trigger right after salary day — so you invest before you spend.

📎 Related: SIP vs PPF vs NPS — What’s Best For You?

📈 Step 5: Track Monthly Like a Money CEO

Even a 30-minute monthly review can make a big difference. Track:

- % of salary saved

- Investment growth

- Expense trends

- Budget overshoots

- Net worth = Assets – Liabilities

Use tools like:

- Google Sheets / Excel — simple, free, and customizable

- ET Money / Money Manager / Jupiter App — Indian-friendly, smart categorization

📎 Download: Free Budget & SIP Tracker – Excel Sheet

🧾 Step 6: Plan Your Taxes From April — Not in March Rush

Smart tax planning = early planning.

Top Deductions:

- Section 80C: EPF, PPF, ELSS, Home Loan (₹1.5L)

- 80CCD(1B): Extra ₹50K for NPS

- 80D: Health Insurance (₹25K–₹75K)

- HRA, LTA: Rent and travel tax benefits

📎 Related: Tax Saving Guide for Salaried in 2025

🎯 Step 7: Link Salary to Life Goals — Or Risk Floating Aimlessly

Don’t let money sit without purpose.

Examples of goals to save for:

| Goal | Target | Timeline |

|---|---|---|

| Child Education | ₹5L | 2027 |

| Home Down Payment | ₹10L | 2030 |

| Retirement Corpus | ₹1 Cr | 2045 |

| Vacation Fund | ₹2L | 2026 |

💡 Label SIPs with goal names for better emotional connection and consistency.

📎 Related: How to Plan ₹25L Education Fund

🔄 Recap: 7 Steps to Mastering Your Salary

- Know your in-hand salary

- Budget using 50-30-20 (or 30-40-20-10)

- Create saving buckets by goal & timeline

- Automate your SIPs and investments

- Track budget and net worth monthly

- Plan taxes early in the year

- Link your savings to life goals

🧠 Final Thoughts: Be the CFO of Your Own Life

You’re the CEO of your work. Be the CFO of your money.

When you treat your salary like a business budget — with systems, structure, and strategy — you stop feeling broke and start feeling in control.

Every rupee has a role. Every month becomes progress.

📎 Download: Free Salary Planner Excel – 2025 Edition

🔗 Explore More on NitinJadhav.com:

- 📈 Best Mutual Funds for Long-Term Investing

- 📊 Free Monthly Budget Planner (Download)

- 💼 Tax Saving Guide for Salaried Individuals – 2025